Industry

On DemandServices

Web AppTechnologies We Use

Python

Keras Tensorflow

OpenCV & MediaPipe

MTCNN

PoseNet

AWS EC2 and S3

Introduction

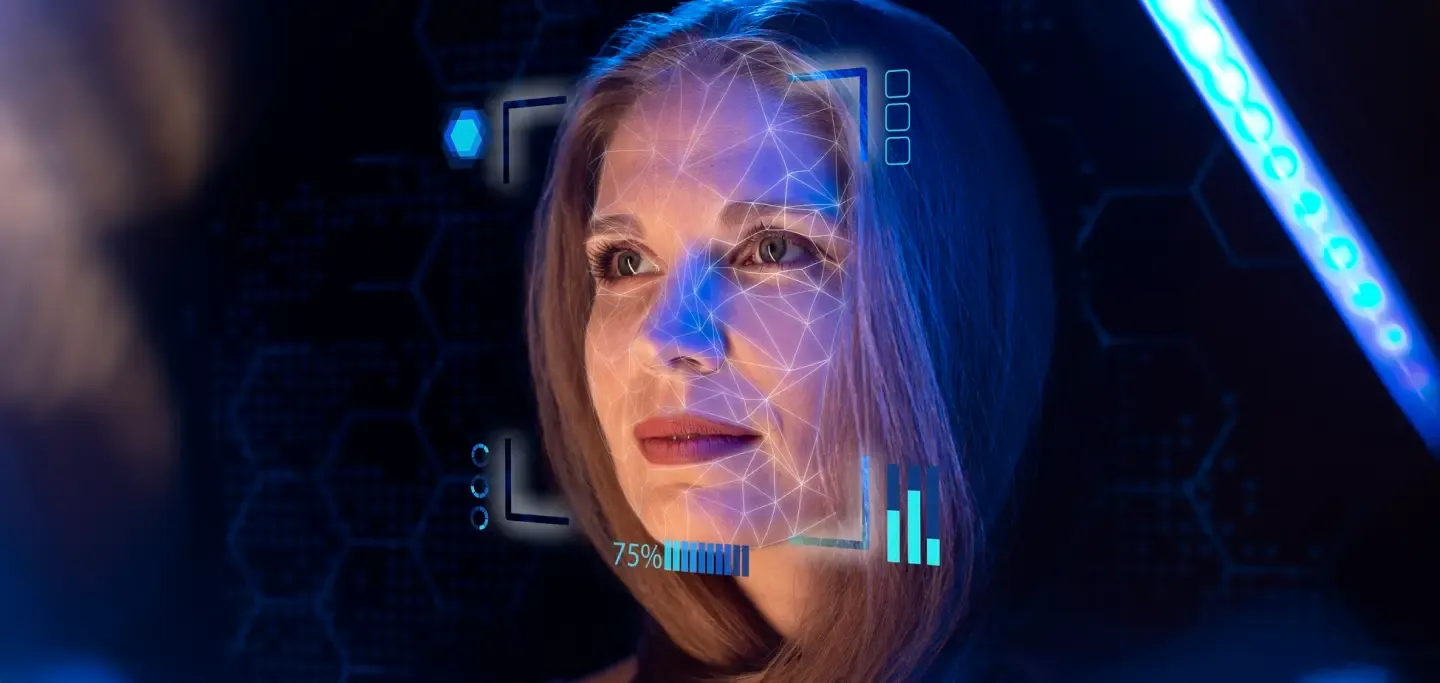

A New Era In Digital Identity Verification

InvoZone developed an AI-driven system to enhance KYC by verifying user identity through real-time video analysis and face matching. The solution ensures security, regulatory compliance, and seamless integration with existing systems.

Key Benefits: Enhanced Security & Better User Experience

Accuracy

The system’s use of deep learning models resulted in highly accurate data extraction from IDs, reducing human error in the verification process.

Scalability

Thanks to the microservices architecture, the system is easily adaptable to new countries and ID types, making it future-proof.

Security

Facial recognition and advanced card area detection ensured only valid, original IDs were processed, strengthening the security of the KYC process.

Efficiency

By automating the document verification and data extraction process, the system streamlined customer onboarding and reduced manual effort, saving both time and costs for businesses.

Regulatory Compliance

Fully compliant with KYC regulations, ideal for industries like banking, finance, and insurance.

Challenges And Solutions In KYC Automation

Preventing Spoofing

Challenge

Ensuring users are actively engaged in the identity verification process to prevent spoofing through fake images or videos.

Solution

InvoZone developed an AI-powered liveness detection system that analyzes facial movements like rotations and expressions in real time, confirming the user’s

Addressing Vulnerabilities

Challenge

Traditional facial recognition methods are vulnerable to spoofing with photos or videos, posing security risks.

Solution

The system integrates face comparison technology, matching live video feeds with stored images to verify identities accurately and reduce fraud.

Streamlining Integration

Challenge

Integrating liveness detection into existing KYC workflows while maintaining security and user-friendliness.

Solution

The solution seamlessly integrates with existing systems, enabling easy adoption without disrupting workflows.

Ensuring Scalability

Challenge

Scalability to support large user volumes while meeting strict regulatory standards.

Solution

Built using advanced AI and cloud technology, the system ensures scalability and compliance with KYC regulations.

The Result

InvoZone’s AI-powered liveness detection and face comparison solution is a game-changer in KYC automation. By combining advanced deep learning and computer vision techniques, the system ensures that identity verification is not only secure but also user-friendly and compliant with industry standards.

The solution’s ability to verify live users, perform face comparisons, and seamlessly integrate with existing KYC systems makes it an invaluable tool for businesses looking to streamline their customer onboarding process while protecting against fraud.

At InvoZone, we are proud to continue developing innovative, scalable, and secure solutions that enhance business operations and provide real-world value.

Company’s Stats

300+

Successful Projects

97%

Success Rate

500+

Developers & Engineers

10+

Years of Experience